Sometimes life kicks you when you’re down. Many people have a sudden need for a loan, but aren’t financially healthy enough to have a good credit score.

If you’re in this position, then don’t sink into despair just yet! There are ways in which you can fix this bad credit and get yourself a loan sooner than you may think.

First, let’s make sure we understand what a bad credit score is.

Understanding your credit score

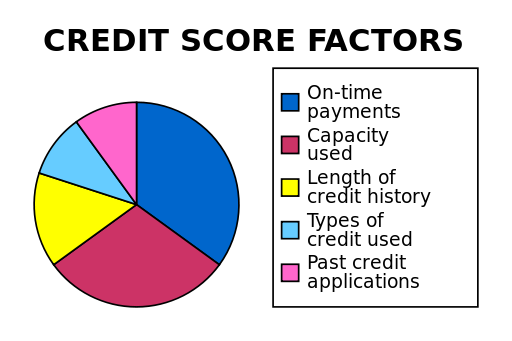

When you apply for a loan, the lender will assess your financial information.Based on that information, they will give you a credit score. This credit score is a way for them to try figure out how likely is it that you will pay them back.

A strong credit score indicates that you’ve been on your best financial behavior! Lenders will probably be happy to lend to you. A credit score rests between 300 and 850 – the higher, the better! If you have a low score, you’re going to seem like a risk – something lenders do not like and will take measures to alleviate.

How credit scores turn into bad credit scores

If you have a less than stellar history when it comes to prior credit arrangements, then your credit score will suffer. If you’ve ever used a bank account overdraft and didn’t get back into the positive for a long time, it will affect your credit score. Exceeding your overdraft limit will have a similar effect.

If your credit score is below 600, you’ll be considered “sub-prime”. Sounds a little insulting, but it basically means you’re considered a risk. Subprime loans do occur, which is something we’ll look into a little later.

No universal credit score

Different lenders may come back to you with different credit scores. This is because you don’t have a universal credit score. Different lenders will have different credit scoring models. Some care more about certain offenses or mistakes than others.

So getting a bad credit score from one lender doesn’t mean you should give up; you can try another lender, who may consider you much less of a risk. However, even one bad credit report usually indicates that you have problems that you should fix as soon as possible. Remember that frequent lender applications will cost you a lot in loan application fees, so consider stopping after three bad credit reports!

How a bad credit score affects you

Getting a credit card is unlikely be a problem, but if you don’t have a good credit score then you’re going to be charged a much higher interest rate. You should also prepare yourself for high insurance premiums if your credit score isn’t healthy, which affects everything from home insurance to life insurance. Home or car insurance are usually the ones that will cost you a lot more. This isn’t just because of your financial history, but also because people with a low credit score are statistically more likely to make claims.

Perhaps you’re already sorted for insurance, or have no desire to get a credit card. But there are other ways in which a bad credit score can affect your life. Applying for a job? A prospective employer can check your credit report in order to determine your suitability for the job (though this isn’t that common.) A more common concern is that a potential landlord can check your score before deciding to rent. Sure, you need to give employers and landlords permission to check your credit score. But if you refuse, you may find yourself being rejected for a job or property anyway.

Modern concerns

A lot of people are wondering what exactly a bad credit score is going to mean in the age of the Donald Trump presidency. Many are worried that being in a precarious financial situation is going to be even less stable once Trump starts getting to work on the economy. Many – especially his voters – believe that the plight of poor, working-class families will be improved in the next four years or so.

The truth is that it’s way too soon to tell. Your best bet is to focus much less on Trump and more on your own situation and the ways in which institutions can help you now. Too many people are spending a lot of time worrying about what the new President is going to do – don’t let that worry translate into inaction!

Is getting a loan impossible with bad credit?

No, and this is very important to remember. Though a lot of people have choice words about the bad credit lending industry, the indisputable fact is that it’s an industry that has helped a lot of individuals and families pick themselves back up again after an unfortunate financial setback.

You must be careful, however. There are some businesses out there who are willing to take advantage of people with bad credit by tying them down with ever more stressful financial obligations and debts. You should probably expect to be paying higher fees, but don’t let this understanding confuse you into accepting a rotten lending deal! It’s also important that, even if you do manage to get a loan with bad credit, that you take steps to fix that bad credit regardless – and as soon as possible.

Fix the problem

You should be aiming to get into as few credit agreements in the near future as you can. Remember that every credit card purchase, no matter how small, is a credit agreement. Consider not using your credit card and instead paying cash for your purchases. (In fact, you may want to consider not making the purchase at all and instead putting that cash towards settling any debts that are negatively affecting your credit score!) Changes in your financial doings are essential going forward.

Paying off due balances is incredibly important. Those debts that aren’t being paid are the big reasons that a credit score will be considered bad. Which means, yes, that you should be looking into living more frugally! This is essential for raising the money to make the payments.

Credit repair

So what if your credit score isn’t improving at the rate at which you need it to improve? It’s possible that there could be errors in the report that are slowing down the process. Credit report errors are actually more common than you may think. They can take the form of mistakes in your personal information, or previous lenders making reporting mistakes.

Worth remembering: if the company carrying out the credit report cannot verify a negative item, then they actually have to disregard it. Let’s say, for example, that you borrowed money from a company a couple of years ago. But that company are actually no longer in business. If their records are no longer accessible, and the company itself can no longer be contacted to verify negative, credit-damaging information further, then the blemish can actually be removed from your credit report outright.

However, it can be difficult to resolve these issues without some form of assistance. When people are convinced that their credit report is more negative than it should be, then they often seek the help of a specialized credit repair service. While it may not seem like a smart idea to put more money into any sort of service, this sort of service can help you tremendously in getting and correcting the information you need. It’s best to ensure you can hire a company that will be able to help, though. Checking previous client feedback is essential, as is assessing the reviews you can find of the company online. Thankfully, there are lists of the best credit repair companies in America available online.